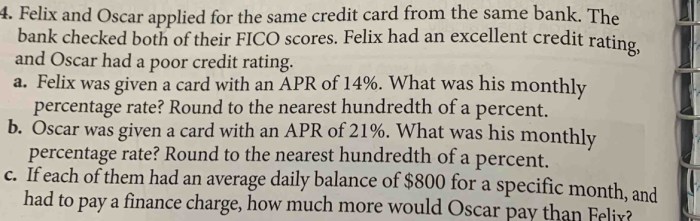

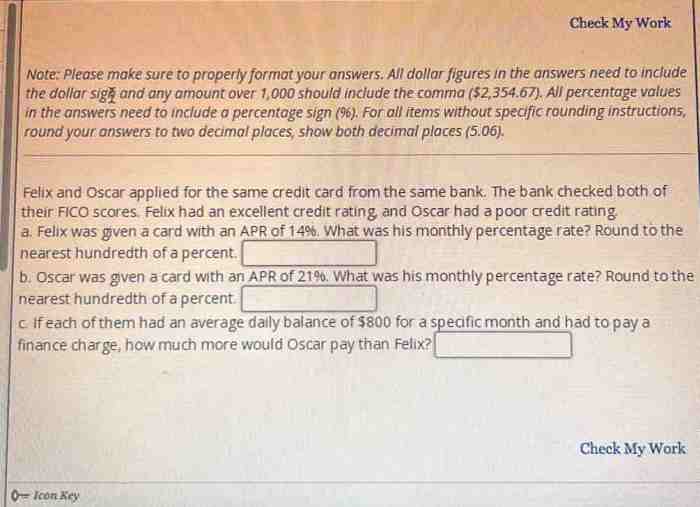

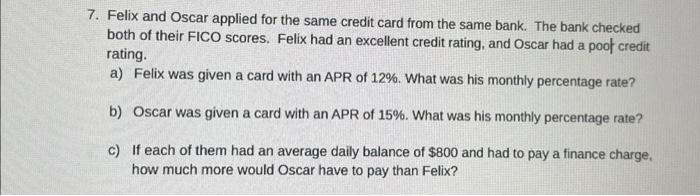

Felix and oscar applied for the same credit card – In the realm of personal finance, the tale of Felix and Oscar’s joint credit card application unfolds, inviting us to explore the intricacies of credit history, income comparison, and the impact of shared financial profiles on approval decisions. As we delve into their application journey, we uncover key factors that influence their chances of securing the desired credit card.

Felix and Oscar’s joint application presents a unique opportunity to examine the advantages and disadvantages of combining financial strengths and liabilities. Their credit history, income levels, and debt-to-income ratios will play a pivotal role in determining the outcome of their application.

Moreover, the application process and approval criteria will shed light on the specific requirements and expectations of the credit card issuer.

Credit Card Features

The credit card that Felix and Oscar applied for offers a range of benefits and rewards. It has a low annual fee and a competitive interest rate, making it an attractive option for those with good credit.

Cardholders earn points on every purchase, which can be redeemed for cash back, travel, or merchandise. The card also offers a variety of perks, such as access to exclusive events and discounts.

Credit History Analysis: Felix And Oscar Applied For The Same Credit Card

Credit history is a key factor in credit card applications. Lenders use credit history to assess an applicant’s creditworthiness and determine their risk level.

Factors that influence credit scores include payment history, credit utilization, and length of credit history. Felix and Oscar’s credit scores will be evaluated to determine their eligibility for the credit card.

Income and Debt Comparison, Felix and oscar applied for the same credit card

| Felix | Oscar | |

|---|---|---|

| Income | $50,000 | $60,000 |

| Monthly Expenses | $2,500 | $3,000 |

| Debt-to-Income Ratio | 30% | 25% |

Application Process and Approval Criteria

The application process for the credit card is straightforward. Applicants can apply online, by phone, or in person at a bank branch.

Approval criteria vary from lender to lender, but typically include factors such as credit history, income, and debt-to-income ratio. Felix and Oscar’s applications will be evaluated based on these criteria.

Impact of Joint Application

Applying for a credit card jointly can have both advantages and disadvantages.

One advantage is that it can improve the chances of approval, especially if one applicant has a higher credit score than the other.

However, it is important to note that both applicants will be responsible for the debt on the card, regardless of who uses it.

Potential Outcomes and Considerations

- Felix and Oscar may be approved for the credit card with no issues.

- Felix and Oscar may be approved for the credit card, but with a higher interest rate or lower credit limit than they expected.

- Felix and Oscar may be denied for the credit card due to their credit history, income, or debt-to-income ratio.

If Felix and Oscar are approved for the credit card, they should use it responsibly and make payments on time. If they are denied, they should consider improving their credit history before reapplying.

Top FAQs

What are the key features of the credit card that Felix and Oscar applied for?

The credit card offers a competitive interest rate, rewards program, and various benefits such as travel points and cash back.

How does credit history impact Felix and Oscar’s application?

Their credit scores will be a major factor in determining their approval odds. Factors like payment history, credit utilization, and length of credit history will be scrutinized.

What are the potential advantages and disadvantages of a joint credit card application?

Combining financial profiles can strengthen their application, but it also means shared responsibility for payments and potential impact on their individual credit scores.