Words with i n c o m e – Words with income paint a vivid picture of financial well-being, economic empowerment, and the pursuit of a better life. From its historical roots to its multifaceted implications in our society, this exploration delves into the intricacies of income, its types, generation, management, and far-reaching impact.

This comprehensive guide unravels the complexities of income, providing a roadmap for financial literacy and empowering individuals to navigate the world of wealth creation and economic development.

Income Definition and Etymology

Income refers to the financial gain or inflow received by individuals, businesses, or organizations over a specific period, usually expressed in monetary terms. The term “income” has Latin roots, originating from the word “introitus,” meaning “entrance” or “inflow.” Historically, income has been used to describe various forms of earnings, such as wages, salaries, profits, and investments.

Etymology

The word “income” traces its roots to the Latin verb “inire,” which means “to go into” or “to enter.” This etymology reflects the concept of income as a flow of resources or wealth entering a person’s or organization’s possession. Over time, the term evolved to encompass various forms of financial gains, including wages, salaries, interest, dividends, and other sources of revenue.

Types of Income

Income is the money earned from various sources. It can be classified into different types based on its source and nature. Understanding the different types of income is crucial for financial planning, budgeting, and tax purposes.

Types of Income

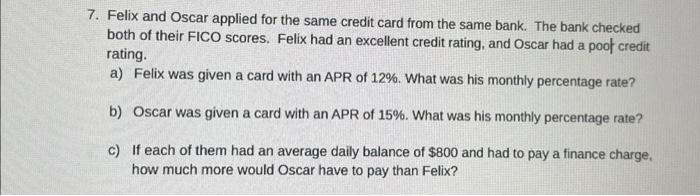

The following table lists various types of income along with their sources, descriptions, and examples:

| Income Source | Description | Examples |

|---|---|---|

| Employment Income | Wages, salaries, commissions, and bonuses earned from working for an employer. | – Salary from a full-time job

|

| Self-Employment Income | Income earned from operating a business or providing professional services as a self-employed individual. | – Income from a sole proprietorship

|

| Investment Income | Returns on investments, such as dividends, interest, and capital gains. | – Dividends from stocks

|

| Rental Income | Income earned from renting out property or assets. | – Rent from apartments or houses

|

| Passive Income | Income earned with minimal effort, typically from assets or investments that generate income on their own. | – Dividends from stocks

|

| Government Benefits | Payments or assistance provided by the government to individuals or families. | – Social Security benefits

|

| Other Income | Any income that does not fit into the other categories, such as prizes, awards, or gambling winnings. | – Lottery winnings

|

Income Management

Income management is crucial for financial well-being. Effective management involves techniques like budgeting, saving, investing, and tax optimization, ensuring your income is utilized wisely and maximizes its potential.

Budgeting, Words with i n c o m e

Budgeting is the foundation of income management. It involves tracking your income and expenses, allocating funds to various categories, and adhering to the plan. By creating a budget, you gain control over your spending, avoid overspending, and prioritize essential expenses.

Words with i n c o m e can be quite tricky, but don’t worry! If you’re looking for information on the pass rate of the CNS Exam , you’ve come to the right place. Just remember, practice makes perfect when it comes to mastering words with i n c o m e.

Saving

Saving is essential for financial security and long-term goals. Set aside a portion of your income regularly, even small amounts, and watch your savings grow over time. Consider different savings accounts, such as high-yield savings accounts or money market accounts, to earn interest on your savings.

Investing

Investing is a powerful way to grow your wealth over time. Allocate a portion of your income to investments, such as stocks, bonds, or mutual funds. Diversify your investments to mitigate risk and potentially earn higher returns. Seek professional advice if needed to determine the best investment strategies for your financial goals.

Tax Optimization

Tax optimization involves utilizing legal strategies to reduce your tax liability. This includes maximizing tax deductions, taking advantage of tax credits, and considering tax-advantaged accounts like 401(k)s or IRAs. By optimizing your taxes, you can keep more of your hard-earned income.

Income Taxation

Income taxation refers to the system of imposing taxes on income earned by individuals and businesses. The principles and practices of income taxation vary widely across different jurisdictions, but they generally involve the following steps:

-

-*Determination of taxable income

Taxable income is typically calculated as the gross income (total income before deductions) minus allowable deductions and exemptions. Deductions can include expenses incurred in generating income, such as business expenses, charitable contributions, and certain personal expenses. Exemptions are specific amounts of income that are not subject to taxation.

-*Application of tax rates

Tax rates can be progressive, proportional, or regressive. Progressive tax rates increase as income increases, while proportional tax rates apply a constant percentage to all income levels, and regressive tax rates decrease as income increases.

-*Collection of taxes

Taxes can be collected through various methods, including withholding from wages, estimated tax payments, and self-assessment.

Different tax systems can have significant impacts on income distribution. Progressive tax systems tend to reduce income inequality by taxing higher-income earners at a higher rate, while proportional tax systems have a more neutral effect on income distribution. Regressive tax systems can exacerbate income inequality by taxing lower-income earners at a higher effective rate.

Tax Systems

There are various types of tax systems used around the world, each with its own characteristics and implications:

-

-*Single-rate tax system

This system applies a single tax rate to all taxable income, regardless of the amount.

-*Graduated tax system

This system applies different tax rates to different levels of taxable income, typically with higher rates for higher income levels.

-*Progressive tax system

This system applies increasing tax rates as taxable income increases, resulting in a higher effective tax rate for higher-income earners.

-*Proportional tax system

This system applies a constant tax rate to all taxable income levels, resulting in the same effective tax rate for all taxpayers.

-*Regressive tax system

This system applies decreasing tax rates as taxable income increases, resulting in a higher effective tax rate for lower-income earners.

The choice of tax system depends on various factors, including the desired level of income redistribution, the administrative costs of the system, and the overall economic and social objectives of the government.

Question & Answer Hub: Words With I N C O M E

What is the difference between income and wealth?

Income refers to the flow of money received over a specific period, while wealth represents the total value of assets minus liabilities at a given point in time.

How can I increase my income?

There are various strategies for increasing income, including pursuing higher education, acquiring new skills, starting a business, or exploring passive income streams.

What are the most common types of income?

Common income types include wages, salaries, dividends, interest, rent, and capital gains.